Lori Ballen, the owner of this website, benefits from purchases made through her affiliate links.

Homeowners weren’t the only ones affected by the real estate bubble and the Great Recession of 208-2009. Renters also felt the shift in the housing market, as well as slight corrections and fluctuations. The relationship between rent prices and home prices may indicate a potential real estate correction, and act as an indicator for investors when to enter the market.

Let’s explore what happens to rents during a correcting real estate market.

Average Rents in Las Vegas

| Month | Sale Price, Median |

|---|---|

| Jan | $2,400 |

| Feb | $2,500 |

| Mar | $2,500 |

| Apr | $2,500 |

| May | $2,500 |

| Jun | $2,497 |

How do rent prices relate to home prices?

According to the Federal Reserve Board, when house prices are high relative to rents (that is when the rent-to-price ratio is low) changes in real rents tend to be larger than usual and changes in real prices tend to be smaller than usual.

That is, if home mortgage payments are closer per square foot to rent prices per square foot, then fluctuations in rent prices tend to be higher, than if there is a greater gap between home prices and rental payments.

Indeed, the rent-price ratio can be an indicator of valuation in the housing market, as well as a barometer for change.

When the gap between housing prices and rentals is high, it may be an indicator that the homes in the area are overpriced. This relationship between what renters are willing to pay versus how much homeowners are willing to spend may indicate that it’s a good market for sellers in the area – or that there is a housing bubble, and prices may make a sharp decline as the market corrects.

At that point, many homeowners may find themselves upside down on mortgages – owing more to the house than their current home value.

Rents tend to be a fundamental determinant of the value of housing in the area, and as such should not move too far out of line with home prices.

When there is a large gap between the two, expect to see a real estate correction of home prices to follow.

According to studies done by the Federal Reserve Board, when prices have been high relative to rents (with a low rent: price ratio), rent increases during the three years following the spike have tended to be larger. It is interesting to note that although rent prices may increase, they do not “spike” in the manner that housing prices do.

However, when looking at house prices that are low relative to rents, the subsequent rent increases have tended to be smaller. Straight housing data supports this theory. Home prices for investment properties at least partially capitalize on the present value of future rents; therefore relatively high prices herald larger increases in rents.

While strictly speaking, rent:price ratios tend to follow a consistent pattern, for an investor, there is are changes in the direct user cost of housing to consider.

What is a Correcting Real Estate Market?

A real estate correction is much different than a real estate crash. In real estate markets, housing prices tend to fluctuate slightly, according to demand. There are many things that affect housing prices, but in general, it’s not unusual to see small housing “bubbles” periodically.

At this point, there’s a small prick in the bubble, and housing values drop. This can be for many reasons, but typically in a free market, values tend to remain within a certain range. When the value becomes too high, and therefore homes become unable to be purchased, the market corrects itself.

A correcting real estate market, therefore, is one that undergoes an adjustment. It’s a relatively minor drop in the value of homes in the area. The market is in correction territory when the home price index falls less than 10% from the highest price within a year. For an average market, this could mean shifts of $20,000 to $50,000 in home prices.

Corrections happen with greater frequency than you might expect, and are generally good for balancing market demand. When inventory is tight, sometimes prices will rise due to demand. Should the demand for owning homes in that market dwindle, then the home prices will adjust themselves back down in response to a lessened demand.

Why is it important to monitor rent prices?

Real estate investors don’t just look at the overall prices for homes when analyzing the market. They also look at debt versus income and spending. Rental payments tend to be more in line with the demographic’s debt-to-spend ratio than home values.

Home prices tend to rise as interest rates drop; rentals, however, have been shown to rise slowly and steadily over time. As interest rates drop, more people are able to make the large purchase of a house.

This demand drives prices, especially in a market that was slower than usual. More interest for home ownership thus results in higher prices.

Rental prices, however, tend to be more of an indicator of how much the population of a market actually will budget for housing. While purchasing a home is both an investment and part of a family’s overhead, rent is simply a piece of the pie. The average income of renters – even renters with a fairly high-income level for the region – determines how much they’re willing o spend on a property.

Although homeowners may make sacrifices to accommodate a larger mortgage payment, you won’t see the same behavior from renters. That is, purchasing a “dream house” or a “forever home” may motivate buyers to spend up to 45 percent of their monthly income on mortgage payments.

Renters don’t typically spend more than 35 percent of their income on housing, even for a “dream home” rental, therefore you won’t see renters spending in the same manner.

As a result, rental prices tend to indicate the true market value of housing more than home prices, when compared year over year.

How are interest rates and property values related?

Low-interest rates basically make money cheaper – that is, more people are able to afford a large purchase for a home because the cost of borrowing that money is less. As interest rates drop, home purchases increase.

As we’ve stated before, when interest in home purchases increases, especially in a tight market, prices rise. Therefore, when the Federal Reserve announces a reduction of interest rates, expect home prices to rise a bit later.

When interest rates increase, then some people become “house poor” if their mortgage interest varies with the market. Those with lower credit scores or fluctuating incomes may find themselves in a bind at this point, with their house payment eating up more of their monthly budget. This type of behavior in the market is what led to the housing crash in 2008-2009.

What do the differences between rental payments and housing costs mean to investors?

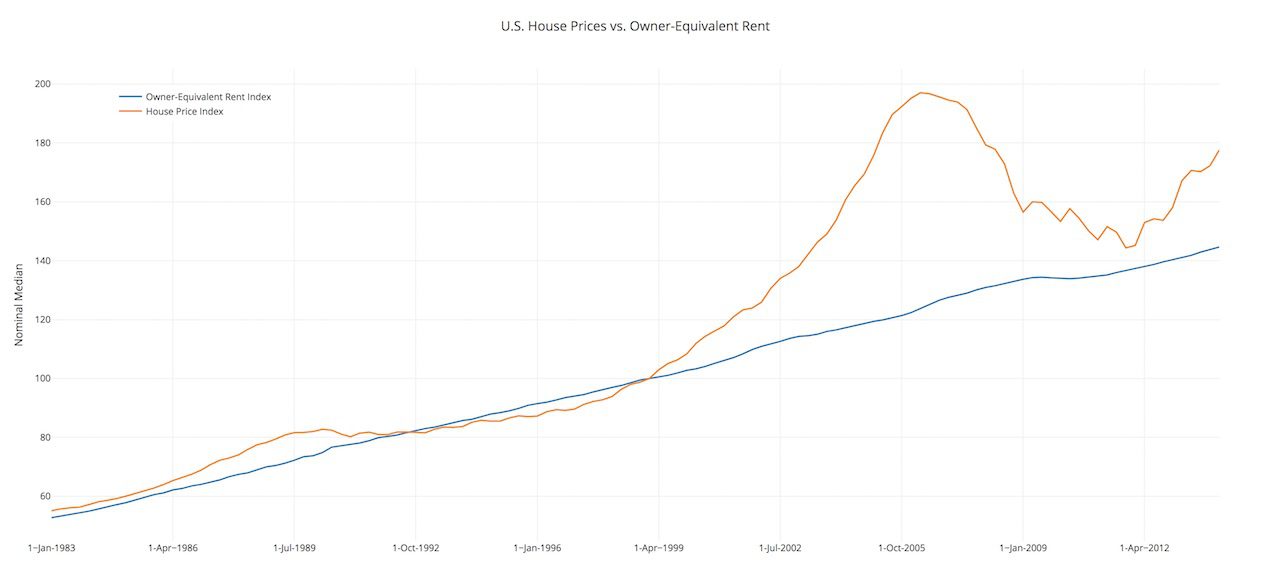

The differences between rental prices and housing prices at the height of the housing bubble in 2005-2006 show a vast gap between home values and rental income. What we see, looking at the data on this chart, is that while home prices rise steadily, then spike over time from 2004-2006, rent prices don’t increase in a corresponding manner.

In fact, they very slowly plod along, increasing slightly over time, but not in relation to the increase in home prices. Even when the housing market corrects itself from 2007-2009, rents stay on the same slow, ever so slightly increasing slope upward.

As an investor, that becomes interesting, when you determine where, when, and how much to invest in your income properties. It demonstrates that rent demands stay the same in response to a variable home value market. In fact, anecdotal reports and studies about the number of people listing rental versus home woning on tax documents show that demand for rental properties increased during the housing market correcting from 2008-2009.

Many attribute this to the rise in foreclosures, short-sales, and pre-foreclosures at this time, as people with variable rate mortgages simply couldn’t sustain the rising house payments.

Making money in real estate isn’t simply when to enter and exit the market like it is on the stock exchange. It’s also a component of time in the market. Looking at rent payments allows investors in gain insight into the “income” portion of real estate investment.

Understanding what rents will be during real estate corrections allows investors to determine with more certainty what their expenses will be as real estate markets correct themselves. In looking at periods in which house prices in a market are high relative to rents, there follow periods in which real rent growth is faster than usual, and real house-price growth is slower than usual.

That response of prices dominates that of rents – a low rent-price ratio indicates that house prices could be too high.

What should investors consider when looking at income properties?

The rent in the area can help investors choose when and where to purchase income properties. Looking at the comparison of a median household price to the median household income is important because it shows how much rent you can reasonably expect to charge. A ratio 6:6, for instance, of house cost to average income in the area, will yield a better investment than a higher ratio gap.

If the area you are investing in has a ratio of 2.5, for example, then your comparison has a big difference and could mean you will not get a high or a quick return on your investment.

As an investor, looking for a good “Cap rate” is important. The Capitalization Rate is an estimate of your potential return on investment (ROI) based on a real estate investment property income. Your cap rate can be expressed as a percentage and will give you an estimate of how much money you can make off each property. A good Cap Rate varies by location – some markets naturally are higher than others, so do some research in your planned investment area. To determine your Cap Rate, use this formula:

[(Annual Rent – Annual Expenses)/Total Property Cost] X 100

The home price-to-rent (annual rent payment total) in an area is critical to determining how quickly you, the investor, can pay off the loan for your income property. To get this ratio, divide the median house price by the median annual rent. Generally, buyers should consider purchasing the property for rental when the ratio is above 20.

Taking an example, if the median house price in the market is $400,000 and the median annual rent for the area is $30,000, then the ratio is 13.3. This means you should probably buy the property because you can pay it off sooner. Investors should use caution, as a high ratio can make the investment opportunity difficult.

How does the Las Vegas Housing market look?

For Las Vegas, specifically, let’s take a look at the market as it is now. Currently, Las Vegas is one of the hottest markets in the country – prices are rising, the inventory is tight, and demand is high. Vegas recently hit an average price range of $400,000 for a single family home.

For investors and home buyers alike, it’s still a good time to break into Las Vegas real estate.

Las Vegas, true to its reputation as the gambling capital of the country, had one of the highest highs of the housing bubble and one of the worst crashes. Prices tumbled, foreclosures were rampant, and building projects were abandoned.

As investors slowly began purchasing income properties, builders scaled back, leading to tighter inventory as the market rebounded. In fact, as prices climbed fast again – from 2013, some years saw increases of up to 10 percent – may fear another housing bubble in the area. Rents continued to rise in 2021, allowing Las Vegas to end the year as the hottest large rental market.

Although the housing market for home buyers is growing in Las Vegas, buyers are still recovering from the crash in the area. Yes, people are buying, and the market is hot for sellers – but is part of that due to a slowdown in new home construction? Perhaps.

Las Vegas is actually the fastest growing rental market among major cities in the United States. Rents have climbed 30 percent since 2012, and the rapid construction of high-end, luxe apartment complexes has added to the supply.

Low inventory of homes for sale is due to many factors. New home construction, while still happening in Las Vegas, especially in the rapidly growing area of Summerlin, is on the rise. With many homes underwater, investors are purchasing income properties at a fairly fast clip. The rental market is responding – while apartment rentals and condo purchases are strong, single family home rentals are high, as well. In fact, Las Vegas seems to be a bit of an anomaly compared to the rest of the country – rent prices have risen at a faster rate than most of the rest of the country, following home prices more closely.

The lack of availability of both rentals and homes-for-purchase, causing a shortage in the market, is one of the main reasons for the higher prices – high demand.

What does the housing market look like for 2021?

Supply for both buyable and rentable homes is still tight – possibly inflating prices more than can be sustained. Expert opinions are mixed, however. Several provisions included in the tax bill that passed last month will directly impact housing. These include changes to the mortgage interest deduction and to property tax deductions.

Experts anticipate this to impact affluent communities on both coasts before the middle of the country, although markets with an abundance of expensive homes like Las Vegas may see more of an effect. As property tax deductions shrink, expect to see movement in counties with high tax rates.

There may not be much movement within the next year, as homeowners affected the most will still be determining whether moving makes sense for their finances.

The new tax law, making it much more expensive to own a home in high-cost of living areas, may actually make renting more appealing to those who would be first-time home buyers. As home prices rise faster than wages, and slightly ahead of inflation, some areas may see potential buyers being forced into renting. This may be especially prevalent in areas with exceptional school systems, as those areas typically have higher property taxes.

Inventory is expected to pick up slightly, with focus on building shifting slightly away from apartments to single-family homes. Investors, however, may still be a large minority of these purchasers. It is unclear right now how many of these investors are planning to rent their income properties out long-term and how many plan to use them in conjunction with an Airbnb listing.

Will 2021 experience a real estate correction?

Although housing prices are rising, this seems to be correlated to the small supply, versus a more unstable inflation in prices like we saw nearly a decade also. Some areas, especially those with prices that rose higher than the national average, such as Las Vegas, may see a small correction. As supply increases in these markets, expect to see a bit of a drop in the average home price.

This may not necessarily be a correction where the home prices are higher than the actual value, but rather moving away from bidding wars that have occurred due to limited inventory.

Right now you’ve got limited inventory and increased buying, and those factors are keeping prices overheated. In addition to this, many sellers – as much as 20 percent – are still underwater, making even short sales tricky. The lack of inventory seems to be the main reason for the higher prices in Las Vegas.

While there may be a foreclosure wave on the way, it’s not likely to change the market in 2021.

Expect rental prices to continue to rise throughout 2021.