Lori Ballen, the owner of this website, benefits from purchases made through her affiliate links.

As an Amazon Associate, I earn from qualifying purchases. Some links on this site are affiliate links. Portions of this content are generated by AI.

In this world nothing can be said to be certain, except death and taxes. ~ Benjamin Franklin

[su_button url=”https://homes.ballenvegas.com/i/cta” target=”blank” style=”flat” background=”#ffc61e” size=”9″ wide=”yes” icon=”icon: home” icon_color=”#ffffff” title=”See Homes Just Listed in Las Vegas”]Click to see Just Listed Homes with Map![/su_button]

If you have made your decision to become a homeowner, you may be in for an unpleasant surprise when applying for a mortgage loan. This could leave you wondering how to raise your credit score to buy a house. Despite the low-interest rates and accessibility of housing loans, many first time buyers find themselves in a bind when their credit score isn’t high enough to be approved for a home loan.

Or, they may be approved, but for an amount far less than they need for that dream house; or at a much higher interest rate.

With the national average score at 695, that leaves half of the buying population under the magical 700 number home loan lenders desire.

Prepare yourself before starting the mortgage applications with these tips to improve your credit score.

Other’s have Asked: What Credit score is needed to buy a house?

[su_divider link_color=”#142ed6″ size=”5″ margin=”30″]

Raise it Fast

Get your bills current.

Your credit card bills are the most important (yes, we know you like electricity and running water, but that’s not what we are talking about here).

You want to make sure that any outstanding bills are paid, and that loan balances are paid down.

For credit cards, you want to make sure that you are paying down the balances in time for the issuing bank to report it to the credit bureau.

Banks and lenders look at timely payments – that tends to be the most important factor in raising a credit score.

This can be any company that reports to the credit bureaus – if you aren’t sure, call them and ask.

But don’t request other vendors to start reporting to credit agencies (like your phone bill).

Although credit agencies are slowly changing what they will accept, right now the only time that they look at the non-reporting bill agencies is if those bills are late.

Because almost all bills are monthly bills, if you go from paying them late every month to paying on time, you could start seeing improvement in just one to two months.

You can also become an authorized user on a family member’s account (or a friend, if they are a very good friend to you).

You can also become an authorized user on a family member’s account (or a friend, if they are a very good friend to you).

Their timely payments and good history will “rub off” onto your credit, as well.

The full history of that piggybacked account will now show up on your credit history. And now, especially if that account is current and in good standing, it will appear as though you, too, have managed a stable credit account for a long period of time.

?Just make sure that the person you are asking actually does pay their bills on time, and has good credit history.

[su_note note_color=”#ffef66″]Just like having another’s good credit boost yours, their bad credit will bring yours down, too.[/su_note]

[su_divider link_color=”#142ed6″ size=”5″ margin=”30″]

Owner Will Carry Financed Homes

How to Increase Credit Score in 30 days

If you are late paying your bills by 90 days, it can reduce your credit score by 100 points! YIKES

Your credit score is based a lot on your “revolving credit” – that is, credit cards.

Installment accounts (such as payday or title loans) aren’t factored in as much. So to raise your credit fast, focus on your credit cards.

[su_highlight]Pay your balances down to less than 30% of the total amount owed.[/su_highlight]

If your credit is bad, or if there is a lot owed, pay those balances down to at least 40%-50%.

It’s not enough to raise your credit into the 700’s, but it will definitely help bring it up.

Paying the credit card bills on time is another way to raise your score. Even a single late payment (past 30 days) can bring your score down 50-60 points.

If you do have a late payment, there are a couple of ways you can act to have it removed.

[su_expand more_icon=”icon: arrow-circle-left” less_icon=”icon: adn”]First, you can contact the original loan holder (usually the credit card company or issuing bank) and ask that they remove the late payment as a “goodwill gesture.” Sometimes, if you agree to set up automatic payments (debited directly from your checking account on the payment due date), the company will remove that late payment. If that is unsuccessful, you can also attempt to contest the late payment for inaccuracy. If you have an account in collection, this will drag your credit score down significantly. But, don’t just pay the debt. A paid collection account will not affect your credit score. Instead, negotiate with the collection agency to pay the debt in return for a “pay for delete” – where they delete the collection action from your credit score. Make sure that you get this in writing, however.[/su_expand]

[su_divider link_color=”#142ed6″ size=”5″ margin=”30″]

How to Improve your Credit by 200 Points

Think of raising your credit score like losing weight.

You can’t drop the extra pounds overnight, and you cannot raise your credit score 200 points overnight, either.

You can’t drop the extra pounds overnight, and you cannot raise your credit score 200 points overnight, either.

Both involve careful choices and smart decisions. And, like losing weight means jumping on the dreaded scale, raising your credit will necessitate pulling your credit report and checking your credit score. You will need to know what you are working with, and what exactly is on there.

The majority of your credit is based on how much you owe, and whether or not you are complying fully with the terms of the loan – are you paying on time.

ON your credit report, check for these. If you have trouble missing payments or paying in time, consider either making a payment reminder (like a calendar reminder or alarm on your phone) or setting up for the bill to be automatically debited from your checking account (autopay).

[su_highlight]Just these two things – payment history and the amount owed – comprise up to 65% of your credit score.[/su_highlight]

Try to reduce your debts – the more debt you have, the lower your credit score is.

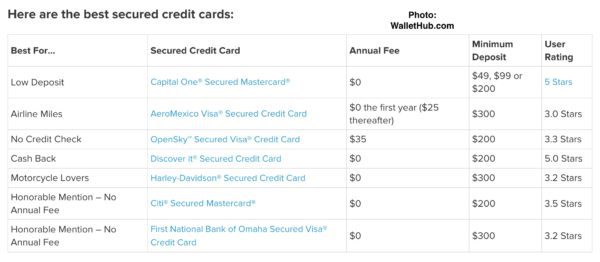

You can also look into secured credit cards, which are cards that you “prepay.”

That is, you provide a cash down payment. Then, you use the credit card like normal, and pay it off each month. (that cash deposit is like a security deposit for the issuing bank).

Eventually, with a track record of paying the balance off in full each month, the issuing bank will change the credit card to an unsecured one and raise your limit.

Just make sure that you continue to make the payments on time!

If you have credit cards that you don’t use, don’t close them. They have “history” on your credit report. Lenders look at how long you have had the credit as an indicator of your stability. Instead, charge small amounts to those inactive cards, and pay off the balances in full each month.

This will give you a history of on-time payments in full, which is very important to good credit.

[su_divider link_color=”#142ed6″ size=”5″ margin=”30″]

In a recent study by Gallup, stats show home ownership is down 10% for ages 18 to 49 Years old.

How to Raise a Credit Score with Credit Cards

Using a credit card wisely is one of the most important things that indicates your creditworthiness (credit score).

Using a credit card wisely is one of the most important things that indicates your creditworthiness (credit score).

Keeping a low balance, and paying it off on time and in full each month, are essential to demonstrate to lenders that you can use credit responsibly.

Good credit essentially is a record of on-time payments. If you don’t have this, as in if you don’t have a credit card, you don’t have good credit; you have no credit. If you are new to credit cards, check your credit score, and then apply for credit cards designed for people in your score range. This will get you the most useful card, and maybe some perks, too, like cash back.

When you pay your credit card in full and on time, the lender reports this to the credit bureaus. Plus, if you pay on time and in full each month, you won’t have to pay interest on your purchases.

Even if you pay on time each month, credit cards may still hurt, rather than help, you. If you carry large balances (like you use half the amount and then pay it off) each month, the credit bureau only “sees” that you are using more than half of your credit.

Good credit entails only having about 30% of your revolving balance used. So if you are using more than that each month, then consider paying half of it down each month – making two monthly payments.

You also want to keep your accounts open. Even if you don’t usually use the account (like a store credit card you rarely visit), the credit reporting bureaus take into account the average age of your accounts. Repeatedly closing credit accounts and opening new ones will bring down the average age of your credit.

Lenders look at a history of your payments and balances. In fact, the length of your credit history with FICO (the data analytics company that compiles credit information and indicates the creditworthiness with a numerical score) accounts for 15% of your credit score.

Finally, be careful when applying for new credit cards. We stated before that you should check your credit score and apply for cards that are targeted to that range.

This is because you are more likely to be approved for these cards. While they may not have high limits or the most extravagant perks, like the cards for higher-scored people, you won’t have a history of repeated credit checks and denials on your credit report.

Yes, each time you apply for credit, those are checked too.

[su_testimonial name=”Sheila Brown” photo=”https://ballenvegas.com/wp-content/uploads/2017/10/Sheila-Brown-River-Parish-Keller-Williams.jpg” company=”Keller Williams” url=”http://sheilabrown.kw.com/about/”]Totally professional, knowledgeable and approachable. I would recommend David Lamer and Lori Ballen Team to anyone needing real estate services. They handled my mom with kid gloves when I referred her to them. ~ Sheila [/su_testimonial]

[su_divider link_color=”#142ed6″ size=”5″ margin=”30″]

How to Raise your Credit Score Without Credit Cards

Credit cards are certainly the easiest way to build good credit.

[su_quote cite=”New York Fed”]The credit card debt in the United States amounted to approximately 0.78 trillion U.S. dollars in the second quarter of 2017.[/su_quote]

They are usually simple to get (even if you have poor credit, you can usually apply for a secured card, with a cash deposit) and easy to use.

With apps for card companies now, they are even easy to pay. Clock, clock done.

However, some people may not choose to use credit cards to raise their credit score.

Or, maybe they aren’t able to get one or have one that really impacts their score. There are other ways to demonstrate a history of paying loans on time and in full.

You can ask to become an authorized user on someone else’s (usually a family member’s) account. The history of that account, including the length of credit and on-time payments, will now show up on your credit report, as well.

Another way to build credit without a credit card is to take out a small personal loan and make the payments on time each month. If you belong to a credit union, you are more likely to be approved for these.

If you don’t bank with a credit union, you may apply to become a member.

Some credit unions have stricter requirements than others (for instance, some are only for employees and families of a certain business, like Widget Factory Credit Union), so you may not be able to be a member.

If your request there is denied, consider asking for a small secured loan. In these, your own money, such as a savings account or certificate of deposit, are used as collateral for the loan.

This is more enticing to the lender, as the risk of default and the lender losing money is substantially reduced.

You can also request a “credit builder” loan – where you borrow a small amount, such as $500, and then demonstrate that you can pay on time, and then pay it off. Also, while you may be paying interest on this loan, it will be less than interest on a credit card.

Another way to build credit is to make sure that your student loan payments are made on time. Student loans are reported to the credit bureaus, and they are looked at as “solid” loans.

Paying these on time (and especially not defaulting!) can have a great impact on raising your credit score. Make sure that the loans are in your name.

If you applied for student loans right out of high school there is a good chance that these are in your parent’s name, not yours. If this is the case, ask your parents to list you as an authorized user on that (or those) accounts. Especially if you are making the payments on the loans, you will want that reflected in your credit history.

[su_divider link_color=”#142ed6″ size=”5″ margin=”30″]

The National Association of REALTORS® reported that 74% of millenials that responded to their home buying survey, said they weren’t buying a home due to student loans.

How to Raise your Credit Score by Paying off Debt

[su_box title=”How Balances Affect your Credit Score”]Balances on your credit cards and outstanding loans are reported to credit bureaus. This is called your “credit utilization”, and it counts for 30% of your FICO credit score.[/su_box]

In order to raise your score, you want to have your debt reduced. A Large debt, even with on-time payments, will lower your credit score. So, to raise your credit score to buy a house, you will want to pay down your debt. Ideally, your credit utilization should only be about 10% of your available credit.

Credit utilization is a ratio of how much credit you have available to you versus how much of a balance you have outstanding on that credit. In order to improve that ratio, you will need to pay down your outstanding debt or raise the amount of available credit you have.

If you currently have a high debt-to-credit ratio, you will probably have a hard time receiving more credit, so your most likely scenario here is to pay off debts.

There are a couple of different debt payoff strategies. The first is the “avalanche” method. In this one, you list all your debts, along with the interest rates. Interest rates are important because as long as you have that debt not paid off, you will be accumulating interest on the loan, which adds to the total dollar amount you owe.

In the avalanche method, you make minimum payments on the smaller interest rates loans, and put all your extra money toward paying off the loan (or credit card0 with the highest interest rate.

the second method is called the “snowball” method. With this one, you make a list of all outstanding debts, ordered by amount owed.

Then, you make the minimum payments on all of the accounts except for the one with the smallest outstanding debt. Once that is paid off, the money you were putting toward it goes to the next smallest debt, and so on – like rolling a snowball.

Finally, there is the “snowflake” method. In this one, every spare dollar you get goes toward paying off your debt. Get a rebate on an item? Put that $5 toward your debt. Win $2 on a lotto scratcher? Pay it on your debt (and hey, you shouldn’t be spending money on lottery tickets – put that spare $1 to your debt).

The small amounts will add up and over time reduce the amount you owe. The thought pattern here is that if you have the extra money on hand, and were planning to hang onto it until you have “enough” to make a payment, you might find yourself spending that money on other things.

[su_divider link_color=”#142ed6″ size=”5″ margin=”30″]

How to earn a Higher Score after Foreclosure

Let’s be honest – a foreclosure on your credit history is not a very good thing to have if you are looking to raise your credit score to buy a house.

[su_youtube_advanced url=”https://www.youtube.com/watch?v=Esx6xu0dI7I” width=”1000″ showinfo=”no” rel=”no” https=”yes”]

However, it’s not a death sentence, either. Mortgages are considered one of the safest forms of credit, so the FICO credit score gives them a higher weight than other types of credit. So late payments and especially foreclosures bring your credit score down substantially.

Even with a foreclosure on your account, you can still incrementally raise your credit score. First, you’ll want to keep your credit cards open and use them wisely. This means not charging a large amount on them, to keep the debt-to-available-credit ratio low. Second, make sure that you pay them off on time each month. This will demonstrate your creditworthiness.

Focus on the debt that you have now – make timely payments, and pay down anything owed. Give your credit score time to reflect these things before applying for more debt and more credit cards.

Now is not the time to open a bunch of credit cards to increase your available credit. Each time you apply and are denied for credit, your score takes a little ding.

Keep tracking your credit score, and when it inches about the “good” level, then you can begin applying for more credit. Erasing the effect of a foreclosure takes time, just be patient.

[su_divider link_color=”#142ed6″ size=”5″ margin=”30″]

How to Raise your Credit Score after a Divorce

In 2016, over 2.15 million women in the U.S. between the ages of 50 and 54 were divorced. @Statista

Divorce is a hard time all across the board.

If you have been depending on a spouse to open lines of credit and pay for joint use things, like a house or car, or even credit cards, you may be in for a surprise when you look to apply for credit or loans on your own.

First, after a divorce, have an income and stick to a budget. You will also want to pull your personal credit report and see where you stand. This credit score will give you insight as to whether your individual credit score is good or bad, and then you can work from there.

If you still have joint debt with your spouse, however, you will need to get that taken care of. If it’s an asset that you aren’t using, such as their personal vehicle, call the lender and ask to have your make removed from the loan.

Their payment history will continue to affect yours. If it is credit cards, again, have yourself removed as an authorized user on accounts and cards that you personally aren’t using.

For things, you can’t pay off right away, consider a balance transfer, refinance, or consolidation. In the meantime, stay on top of those payments, as the joint accounts will still be reflected on your own credit history.

Change your last name before applying for new credit. These new lines of credit will be in your new legal name, and therefore should not be tied to the other debts.

You will need to build credit of your own. Work on some of the strategies above for those just starting out, as you may be doing just that on your own. Keep balances low, pay them off each month, and pay on time.

Raising your credit score to buy a house takes time and patience. With proper credit management, however, as well as using the strategies above, you can raise your score substantially over a year’s time. Use discipline and self-control when spending and saving, and pretty soon, you, too, can be in your dream home.

If you are wondering how to raise your credit score to buy a house, here’s the summary.

- Pay your bills on time

- Pay down balances prior to credit bureau reporting

- Piggy back on good credit accounts

- Contact Creditors to remove bad debt

- Reduce total debt

- Keep paid off credit cards open

- Keep your credit balance owed at under 30%

- Take and pay off a personal loan

- Consider secured credit cards if you don’t have credit

- Avoid applying for new credit if you have a good amount.

- Use the avalanche or snowball method to reduce interest rates

As an Amazon Associate, I earn from qualifying purchases. Some links on this site are affiliate links. Portions of this content are generated by AI.