Buying a home in Las Vegas is a big decision. There is a lot to consider. There are no real secrets for buying a home as much as there is advice. Even if you have bought a home in Nevada before, you may not remember every step in the process.

[su_youtube_advanced url=”https://youtu.be/AVX1s5GK9Ng” width=”1000″ height=”280″ showinfo=”no” rel=”no” https=”yes”]

Table of contents

- Do You Qualify To Buy a Home?

- How Much Home Can You Afford?

- Determine The Downpayment

- Get Pre-Approved for a Loan

- Loan Programs

- Home Owners Insurance

- Determine your Housing Needs

- Decide Where you Want to Live

- Do Schools Matter?

- Your First Time Looking At Houses

- Making An Offer

- The Purchase Price

- Earnest Money Deposit (EMD)

- Escrow

- Due Diligence

- The Home Appraisal

- The Home Inspection

- Final Walk-Through

- Costs When Buying a House

- Timeline When Buying a Home in Las Vegas

- Frequently Asked questions

- Glossary of Frequently used Real Estate Terms

Do You Qualify To Buy a Home?

Before you get too excited about and committed to the idea of moving, it’s a good idea to speak with someone in Mortgage that can help you determine what you would qualify to buy.

You can shop for mortgage lenders online, ask for a referral from someone you trust, or contact a real estate agent that partners with various lenders.

You can call or text Lori Ballen Team at 702-604-7739 and speak with a skilled agent that can help you with this connection.

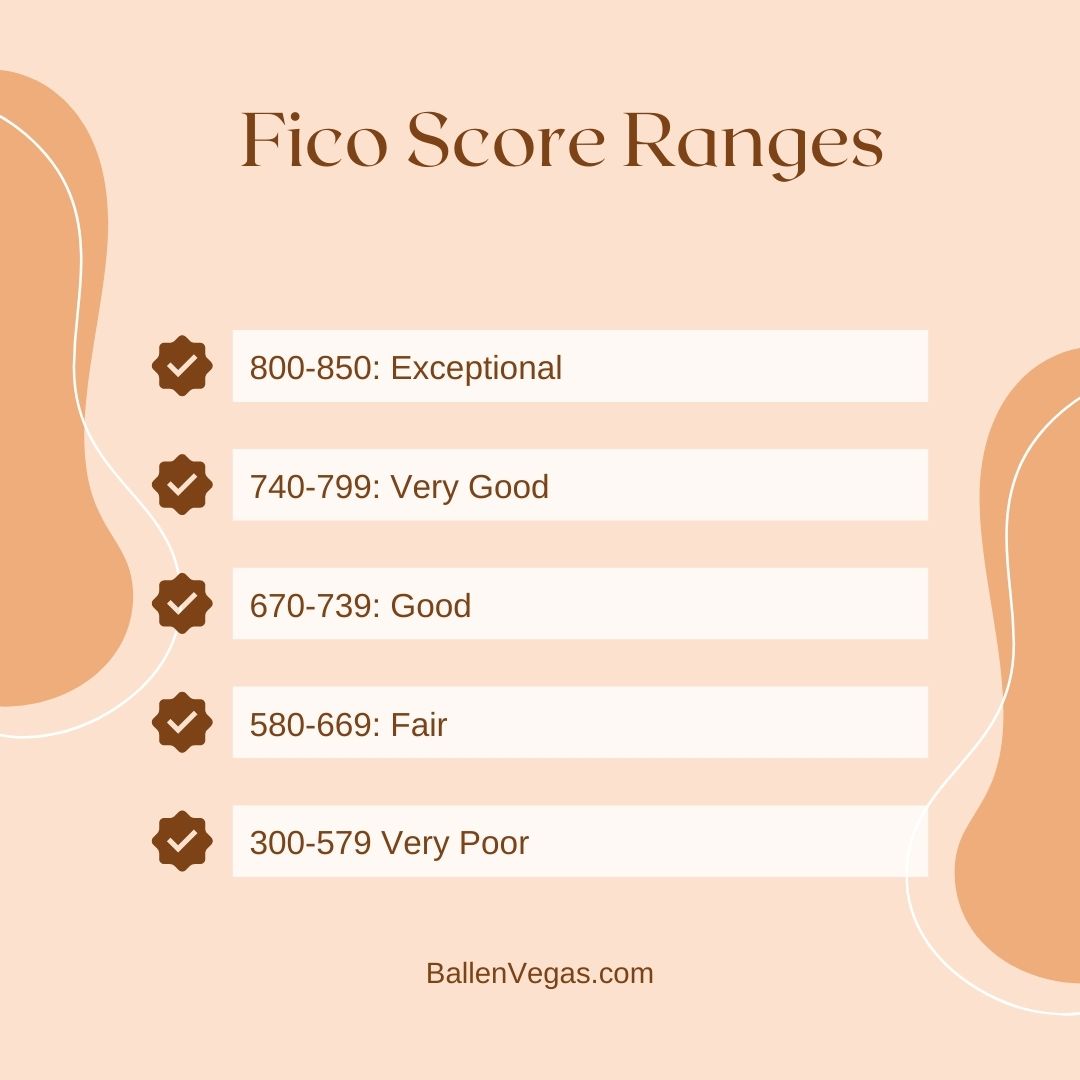

Many first-time homebuyers are scared to start the process because they believe their credit score is bad or too low.

They are worried about their income or length of employment, and many other thoughts concerning them about their qualifications.

In many cases, these home-buyers will qualify.

And if not, it’s better to find out on the front end than go out looking at homes and fall in love only to find out you can’t buy it.

How Much Home Can You Afford?

A common rule of thumb for determining the price of a home you can afford is that your mortgage payment should be between 25 and 30 percent of your income.

If your household earns $100,000, you could potentially afford a $250,000 – $300,000 home.

In truth, 30 percent is too high for many people.

The only reliable way to determine what you can afford is by adding all of your monthly bills and expenses.

Make sure to get estimates of what your new utilities will cost based on the size of the home you plan to purchase.

Use the following calculations to estimate potential monthly payments on the balance of a loan after your downpayment.

[table id=149 /]

Determine The Downpayment

Honestly, it’s best to not let this overwhelm you before talking to a lender. There are down payment program options and ways to avoid a large down payment if you don’t have one.

You may still need to pay for appraisals, inspections, closing costs, and moving expenses, and again, it’s best to have this conversation with the lender to get options and real numbers before you go house shopping.

If you can save enough to put 20 percent down, you will be much more attractive to lenders.

Additionally, loan products with a 20 percent down payment requirement are easier to obtain if your credit is less than perfect.

However, if you can’t save that much, don’t be discouraged. There are plenty of ways to buy a home with little to no down payment. However, your interest rates may be a little higher, and you will have to pay private mortgage insurance.

Get Pre-Approved for a Loan

The purchase of your home is most likely going to be the largest and most important purchase of your life. Getting out there and looking at real estate might be fun and exciting, but you don’t want to get your heart set on a house only to find out that you won’t be able to qualify for it.

The process to buy a home includes gaining pre-approval which can cut through the mystery and give you an idea of the price range you need to be looking in. It saves time for you, the lender and the seller. Let’s explore what the process involves for each party.

You’ll want to sit down with your potential lender before you shop to purchase a house and have them analyze your entire financial history and abilities so that they can give you a tentative approval for a certain amount of money.

They will present you with a letter that states how much money they are willing to commit to financing you for the purchase of a home.

Debt To Income Ratio (DTI)

You may not qualify for a mortgage loan if your debt is too high for your income. Basically, lenders want to see that you owe less than around 35% of what you earn.

Your lender may ask you to pay off a certain percentage of your debt in order to qualify.

To get the best interest rates on a home loan, you’ll want to be considered a low risk to get into the best programs.

A front-end ratio will also be considered. That includes your standard monthly living expenses.

Debt to Credit Ratio

If you owe more than 50% of your income number including auto, credit cards, student loans, personal loans, etc., it’s a good idea to pay that down before you buy a house in Las Vegas.

Lenders look at how much credit you have available compared to how much you are using. You are a much higher credit risk if you are using more than 50% of your credit available.

They also consider escalating debt which means during a recent time period, your use of credit increased.

These numbers are also reflected in your credit score.

Using less than 30% of your total credit available is a great goal.

Having high debt doesn’t necessarily mean you won’t’ qualify but it can change the loan programs and interest rates available to you.

Length of Time for Pre-Approval

Since the potential lender will have to sift through bank records, pay stubs, payment histories and credit scores it could anywhere from a couple of days to a couple of weeks or more. It is worth the time and effort so that you know exactly what you can and cannot afford when it comes to a home for sale.

The real estate market is very competitive, so having the advantage of a pre-approval letter can make all the difference in getting the home you want and need quickly.

Buyer Participation

As a buyer, it is critical that you provide the possible lender with all of the documentation they need to give you a true and accurate assessment of your financial abilities to pay a mortgage.

Tax returns, life insurance policies, stocks and bonds and existing real estate that you have successfully paid for in full are all helpful to painting a good financial picture. Pre-approval amounts will be dependent on your ability to pay and the payment history that you have.

You need to make sure that you walk away with a pre-approval rather than a pre-qualification letter.

A pre-qualification is simply a quick assessment of your ability to jump into the real estate market. The pre-approval letter will show exactly what house price you can actually afford with your current budget.

Importance to Seller

A seller doesn’t want to waste a lot of time showing a home or having to do paperwork that simply falls by the wayside if a potential buyer cannot score a mortgage. Their time is valuable and they need to know that the potential buyers (YOU) are serious and have the income needed to purchase a home.

How the Real Estate Agent Can Help

Once the baseline of pre-approval is complete, your agent can bring the right buyers and sellers together. The real estate agent can put the right budget with the most affordable properties in that price range. They work much like the conductor of an orchestra.

The great thing is that this process of being able to know ahead of time the price range to look in saves time, money and frustration. It is just as unpleasant for the agent to learn that a buyer doesn’t qualify as it is for the potential buyer.

Selling homes is what a real estate agent does for a living. The faster and more accurately they can make a good match to the buyers and sellers the quicker they earn a commission. It is a win-win situation for all involved.

Private Mortgage Insurance

Private mortgage insurance (PMI) is what lenders use to protect themselves from risky borrowers. If you put down less than 20 percent, you will probably have to pay PMI every month as part of your mortgage payment. As your down payment decreases, PMI rates go up. Speak to as many lenders as you can to learn what rates to expect.

Make sure to ask how long you will need to pay PMI. Some loans, such as those backed by the Federal Housing Administration, will require you to pay PMI for the life of the loan. Other products will allow you to cancel PMI after you have paid enough towards the principal balance.

[su_divider]

Interest Rates

Interest rates can make or break a loan deal. A slightly higher rate can add a large amount to your monthly payment and end up costing thousands of dollars more over the entire loan term.

There are many ways you can lower your interest rates. Start by visiting a loan officer wherever you do your banking and ask for a copy of your credit report that includes the credit score.

Do what you can to eliminate any negative marks on the report to improve your credit score.

You can also look at mortgage products that allow you to purchase discount points. Discount points will cost one percent of the loan amount and will usually lower the interest rate by 0.125 percent. Paying for discount points is often a good option if you don’t plan on selling or refinancing the home in the foreseeable future.

[su_divider]

Loan Programs

Home is Possible

Here are the basics for the down payment assistance programs that are currently active in Nevada.

Home is Possible

- Minimum credit score of 640

- Up to 5% in grant funds

- Purchase price up to $484,350

- Income limits up to $98,500

Home is Possible for Teacher’s

- FHA, VA, and USDA only

- Income up to $98,500

- Purchase price up to $484,350

- $7,500 toward down payment and closing costs

Home at Last

- Only eligible areas of Nevada qualify

- Minimum credit score 640

- Up to 5% in grant funds

- Purchase price up to $484,350

- Income limits up to $135,000

WISH

- 3-1 match down payment assistance program, up to $16,000

- Income must be 80% of the area AMI or lower

- A Minimum credit score of 580 or no score reporting

- HUD-certified HomeBuyer class required

- Must be a first time home buyer

Culinary Down Payment Assistance

- Borrower must work for the culinary or bartender’s union

- Up to $20,000 to go toward down payment and allowable closing costs

- Borrower must put down 3.5% of their own funds for FHA and 1% for Conventional

- HUD certified HomeBuyer class required

- Must be a first time home buyer

- Agent must be certified with NV Partner’s

- Income limits up to $83,750 for 2 or more people in the household $105,350 for 3 or more people in the household

Taxes when Buying a House in Las Vegas

In most cases, property taxes will be added to your mortgage payments as well. Property tax rates are relatively easy to find by visiting the county auditor or tax department’s website and doing a property search. If you don’t have a property in mind, call the tax department and ask about the tax rates.

Here are the Clark County Tax Rates.

Home Owners Insurance

Getting Home Owners Insurance may require some persistence on your part. If an insurance agent thinks you are just window-shopping, they are likely to give vague answers.

It is also difficult to give ballpark numbers because of the many variables among homeowner’s policies.

To avoid the hassle, start by asking family and friends what they pay for homeowner’s insurance. If you don’t know anyone in the area you are shopping, talk to your realtor.

A realtor’s referral will show insurance agents that you are serious about buying a home, and they will be more likely to spend time answering your questions.

[su_divider]

Determine your Housing Needs

Congratulations, you have decided to buy a home. You’ve made a great decision. But you may be asking yourself, “How do I know what is right for my family?”. Here’s what you want to consider:

1.) Your Home should Fit the way you live or WANT to live. Space and features for the entire family should be considered. If it’s just you, you get to choose for yourself then and that’s wonderful too!

2.) Make a list of your priorities. You’ll want to consider location as a priority although here you can make it to one side of town to the other in 30-40 minutes. Should your home be close to a particular School? Do you want to live near work? Are you curious about what transportation is nearby? Do you want a pool? Single story or Two Story? HOA? Do you need land or special zoning such as for horses?

3.) How large should the home be? Does the lot size matter?

[su_divider]

Decide Where you Want to Live

Fair Housing laws prohibit your real estate agent from guiding you towards or away from a particular neighborhood. You are best to do your own research on the general areas based on what’s important to you. Your agent can probably get you a zip code map and you could begin there. In Southern Nevada, there are a lot of zip codes to look at. You may want to consider areas by average home sold price range so you know where you are able or have the desire to shop.

You can also explore neighborhoods specifically. Las Vegas is made of Master Planned Communities that each offer their own amenities and lifestyle. Each neighborhood here has a subdivision name as well. Some communities will be part of at least one homeowner’s association. If that’s important for you to know, be sure to ask your agent as you are browsing where to live.

[su_divider]

Do Schools Matter?

When you are in the process to buy a home, and you have school-age children, you might want to pick a neighborhood based on which school it is zoned for. All schools here are part of the Clark County School District.

The house address itself is specifically zoned for a particular set of schools. These are generally elementary (K-6), Middle School (7-9) and High School (9-12). We do have 6th-grade centers here as well in some areas. Although a real estate agent is required to list these schools in the MLS when they place a home on the market, they aren’t always up to date.

We suggest you check the Clark County School District Zoning page before you make an offer on a home. Your agent can also verify this for you.

[su_divider]

Your First Time Looking At Houses

Once financing is complete, and you have determined your purchasing power, your agent will schedule a home tour. Some will request that you meet to view the listings online before venturing out. The agent can call ahead and check if there are existing offers, and schedule appointments for occupied owner showings.

Allow approximately 2-3 hours for your tour depending on your home selection. You may choose to ride along with your agent or follow in your own vehicle.

Home Buying Tips

- Have all decision-makers on the tour

- Be prepared with things to keep the kids busy on the tour so you can focus on notes and questions

- Bring a digital camera and take pictures of each home or better yet, capture video. Your smartphone is great for this. Your designated agent would be happy to follow along and record for you so you can take notes.

- Have a pen/pencil and notepad to make notes. You will forget. It’s important to note LIKES and DISLIKES for each home.

- Example: Island in the kitchen is amazing. Example: 3rd room for the nursery is a bit small Example: Love his and her walk in closets in master Example: Yard will require new landscaping

- Departing each home, Rank the home on a 1-10 scale on how likely you would be to write a compelling offer

- During the hot months, frozen bottles of water are a great idea for the trip. Some homes will not have power or air conditioning

- Don’t wear shoes that you are worried about scuffing.

- Be prepared to write an offer. There is not much sense in touring homes when you are not prepared to buy, as those homes are certain to not be available at a later date. If we have done our job, as your eal estate agent, you are prepared, have selected strong candidates, have your financing, have a comfortable knowledge of the process and you are ready to buy.

[su_divider]

Making An Offer

When first-time homebuyers begin the house-hunting process, they often don’t realize just how many steps it entails. From securing a loan to finding a property you love to negotiating the purchase, it can feel like the process will never end.

Luckily, if you have made it to the offer stage, the finish line is finally within reach. Together with your real estate agent, you can make a bid on your dream home and hopefully seal the deal. In order to improve your chances at getting the house, however, your offer needs to be as strong as possible. Here is a look at some things to consider as you work with your real estate agent to draw up your contract.

The Purchase Contract

Unless you are acting as your own real estate agent (in which case you should probably have a lawyer draw up the offer for you), you shouldn’t have to be the one doing any paperwork. Still, it’s important for buyers to understand the sorts of terms and contingencies a typical offer contains.

In addition to the basics–like the address of the home and all of your personal details–the agreement will lay out the sale price, a target closing date, the amount of earnest money you will be required to put up, and any other contingencies that you are asking for. Your offer will also give a timeframe during which the sellers need to respond.

The Purchase Price

Obviously, the element of the offer you are likely to be most concerned about is the price of the home. First-time buyers often have trouble deciding how much money to offer on a home, which is why it’s very important to work with someone you trust.

Remember that the housing market determines how much a property is worth, so your agent will look at similar homes that have recently sold in the area in order to help you come up with a reasonable offer price. You should go into the negotiating process expecting to receive at least one counteroffer from the seller (so it’s rarely a good idea to offer top-dollar for a home right off the bat). You may also decide to make a lowball offer just to see how flexible the seller might be, but you need to be careful not to offend the seller by making an offer that they feel is way too low.

Terms and Contingencies

While the price is usually the most influential factor when a seller decides to accept or reject an offer, there are other terms and contingencies that may impact negotiations. Almost all real estate professionals suggest that you insist upon a home inspection, for instance, so that you have the ability to back out of the purchase if you find out the property has problems that aren’t obvious to the naked eye.

You may also want to write contingencies based on your ability to secure financing or sell your current house (not an issue for first-time buyers). Something as seemingly arbitrary as your chosen closing date might make a seller more likely to accept your offer–especially if they have already bought a new property and are anxious to move out. As a general rule, you should choose your offer terms carefully based on the specifics of the home you are considering.

Make sure to find a balance between making your offer as appealing as possible and protecting yourself against any potential issues.

Presenting The Offer

The final step once you have come up with an offer you’re happy with is presenting it to the seller. Negotiations can often feel like a game of telephone as your agent communicates with the listing agent, and then the listing agent communicates with the seller.

You have the right to back out of your offer for any reason up until it is accepted. If the seller comes back with a counteroffer, you also have the choice to either accept the agreement or write another counteroffer yourself.

Once both parties agree on an offer, you will both be bound in a contract, and you may not be able to change your mind without losing some or all of your earnest money. When you have finally sealed the deal, the home will officially be “under contract” as you await your chosen closing date. Barring any unforeseen issues, a signed contract essentially means that you have bought yourself a house, so you can congratulate yourself on finally reaching the end of a long process.

What to Ask For in the Purchase Contract

Disputes often arise in home sales when buyers and sellers go into a deal with different understandings about what property will be included in the sale. While the law provides some guidelines, it isn’t always clear and there’s no guarantee that the other side will be aware of it or follow it.

The best course of action is to include each specific item you care about in writing — anything can be bought or sold even if it might not legally be part of the home purchase to begin with. Below are the general practices with regard to various items to use as a starting point in negotiations.

Appliances

Generally, the rule is that permanently attached appliances stay and freestanding appliances go. Permanently attached means built into the home such as a range, cabinet-mounted microwave, or dishwasher. Freestanding items include refrigerators, washers, and dryers no matter how conveniently they fit into a space specially designed for that type of appliance.

If you are impressed by a home with high-quality appliances, be sure that they are specifically included to avoid them being switched with cheaper appliances. On the other hand, if you want something out, have that included avoiding the time and expense of having to dispose of it yourself.

Air Conditioning and Heating Systems

Air conditioning and heating systems follow the general rule of other appliances. Permanently installed central or ductless systems stay with the house, but window-mounted units go.

In addition to the usual precautions with appliances, be sure to determine the age of the system. Older systems may need to be replaced or need new ductwork that can be very expensive. Newer systems may still be under a transferrable warranty that may cover repairs for years.

Lights and Ceiling Fans

What is and isn’t permanently attached becomes a grayer area with lights and ceiling fans. They may be attached overhead, but they can and often are quickly removed. This is especially true of chandeliers, and other decorative lighting, or top-of-the-line ceiling fans. While they probably should be included along with the light bulbs inside, be sure to include them in the contract to avoid unpleasant surprises.

Window Coverings

Window coverings usually seem like they should be included, at least to buyers, because they are almost always custom-fitted to that home’s windows. However, blinds, curtains, and curtain rods are commonly removed by sellers.

Curtains might be reasonably removed because they can often fit various sized windows and are bought to match the furniture. The removal of curtain rods or blinds, however, leaves empty holes in the wall, so they are more commonly included.

Decorations and Furniture

Decorations and furniture are almost never included no matter how well they might fit the space. This includes mirrors, bookshelves, and mounted art. If a buyer sees an item that they think just makes the room, they can always ask the seller. The seller might want to leave it because it is hard to move or won’t fit their new home, or might be willing to part with it for a price.

Electronics

Traditionally, electronics were never included in a home sale unless specifically added as a bargaining chip. With wall-mounted TVs, built-in stereo systems, and more complex home entertainment systems becoming more common, buyers have increasingly argued that they should have been left when the seller took them. Electronics might be bargained for, but they should never be assumed to be automatically included in the contract.

Exterior Structures

Homes with large yards often have play equipment, above-ground pools, sheds, dog houses, or other structures that aren’t part of the home. The fact that they are usually prefabricated and dropped off with a truck often makes them seem like they are removable no matter how well they are attached to the ground.

In some cases, a buyer might want an item removed while the seller was planning to leave it behind. These items are usually large enough that whether they will remain should be included in the listing, but never make any assumptions if the listing doesn’t explicitly say yes or no.

[su_divider]

Earnest Money Deposit (EMD)

The earnest money deposit is money that is placed into an escrow account. It is sort of like a security deposit. It informs the seller that you are a serious buyer.

The funds will be applied to the closing of your transaction. This is required in all real estate contracts. If you don’t have at least one percent of the sales price to offer as an earnest deposit, you should wait on placing any offers until you have the funds available.

If you are making an offer in a competitive market, you may want to increase your earnest deposit to make your offer stronger than the other offers.

The earnest money deposit is placed into the escrow account within a few days of an accepted offer so you need to make sure you have the funds available for immediate withdrawal.

If you decide to cancel the contract while you are in escrow, there is a chance that the seller may be entitled to your deposit. Make sure you read the contract thoroughly so you will know what to expect.

Know this, even if you are within your full rights to cancel the transaction and receive your earnest money back, in some states like Nevada, the seller has the right to hold it up during a dispute over the earnest money.

When you place your earnest money check in escrow, there is no guarantee of a quick return should you decide not to by the home for any reason. Ask your REALTOR® about your state laws.

Also, be sure to read your counter offer clearly. It’s not unheard of for a seller to ask the money to “go hard” after a certain point. That would mean they receive the earnest money in full before closing.

Your earnest money should not be taken lightly.

By definition: Earnest: resulting from or showing sincere and intense conviction.

If you don’t intend to buy, don’t put earnest money on the table.

[su_divider]

Escrow

What You Need To Know About Escrow

One of the most confusing processes for the uninitiated to go through can be buying of a home. At times it may seem that people are speaking a different language than they have ever heard before.

This situation too often leaves a home buyer having to take on blind faith that the brokers, attorneys, escrow agents, inspectors and mortgage agents know what they are doing and acting in the buyer’s best interest.

Opening Escrow

The escrow or closing process actually begins once the buyer and the seller have agreed on a price and all the conditions for the sale. At the same time that the sales agreement is signed your real estate agent will collect an agreed-upon percentage of the sale price from you and deposit it into an escrow account with an escrow agent.

This known as earnest money and as the name implies it is to show that you are earnest in your desire to buy the property. Think of it as a deposit.

Your Escrow Officer

An escrow officer is a neutral third party who actually handles all of the funds and documents associated with the buying and selling of the property.

Not being a party to the sale, in any way, their function is to make sure that all parts of the sale are executed in an equitable and legal manner. Like a referee or umpire the make sure the rules are followed and that everyone plays fair.

[su_divider]

Due Diligence

There will be a written period stated in the contract of which both buyer and seller agreed-upon for the Due Diligence period.

The buyer states their requested time in the purchase contract and the seller counters back with another time or agrees when they sign the purchase contract.

This is the time for you to inspect the home, complete loan requirements, read the Home Owners Documentation and investigate anything else that you would need to do before the property closes.

Make sure you discuss this with your agent so you know what is expected or offered during this time.

During this time:

- Drive through the neighborhood day and night

- Inspect the HOA documents completely

- Check out the schools

- Have a home inspection

- Have a pest inspection

- Review the Seller’s Real Property Disclosure and ask any and all questions

[su_divider]

The Home Appraisal

As the home buyer, you will probably be requesting an appraisal. If you are getting a loan to buy your house, an appraisal will be part of the process.

This is a professional appraiser’s estimated value of the property. The appraiser will use recent properties that have sold in the area to help determine the value of the home you choose.

What’s Your Home Worth?

Instant Online Home Value Calculator

The appraiser will also consider the condition of the home, age, size and so forth in determining the value.

If the house is appraised low, you may need to amend the purchase price to have the loan approved.

In some cases, the seller may still hold to their original asking price and ask you to pay the difference in cash.

Since the loan contingencies are typically written into the contract, you can cancel the purchase contract of the terms aren’t met.

It is not likely to receive a loan amount for higher than the appraised value of the home for purchase.

If the home appraises at a higher value than the buyer and seller contracted for, congratulations, you’ll have equity after closing!

The home appraisal process includes the following:

- A complete walkthrough of the house to get an idea of the overall condition and room count

- Documentation of the entire condition of the property, both inside and out.

- The Quality of construction and modernization of the home

- An evaluation of the value of the house

- Information on the house, including square footage, and the condition of the garage, carport, or other peripheral properties

- Estimates of the “contributory value,” which is any additions or repairs you have done to the home prior to listing

- Other attributes of the home which would add to the market value of it

ONE CAVEAT

It is important to note here that an appraiser is NOT an inspector. For this reason, he or she cannot do structural assessments, termite checks, under the floor evaluations, or any of the other things the home inspection team can do.

This is why it is important to have both a pre-home inspection and a pre-home appraisal completed prior to listing your house for sale.

[su_divider]

The Home Inspection

Before purchasing a home in Nevada, a buyer usually turns to a home inspector to receive a qualified, unbiased account of the state of the property.

A home inspection is a noninvasive, limited visual inspection of a home. It identifies the components of the home that are unsafe or not meeting performance expectations. The purpose of the inspection is to evaluate the home and enable the potential buyer to make an educated decision regarding its purchase.

Many times, a contract to purchase a home includes a contingency clause stating that the contract is invalid until the buyer has had the opportunity to verify the condition of the home they are purchasing.

A home inspection is often a given in today’s Nevada real estate market, and can in fact make or break the sale. It enables the buyer to know exactly what they are purchasing, and can be a great source of anxiety for a seller that is unprepared.

The inspection is generally carried out by a professional home inspector that is trained and certified in home inspections. In Clark County Nevada, home inspectors receive their certification and regulation through the Nevada Real Estate Division.

What is Inspected?

A thorough home inspection can take several hours and will reveal problems that may go unnoticed in an initial walkthrough. Because buying a home can be an emotionally charged experience, a realistic evaluation of the home is a crucial part of determining the wisdom of the purchase.

The home inspection gives the buyer an accurate, unbiased view of what problems to expect and what issues must be addressed before moving into the home.

The home inspection includes the evaluation of many components, including:

- the heating and central air conditioning systems

- electrical systems

- plumbing

- the roof

- visible insulation

- the attic

- floors

- walls

- ceilings

- windows

- doors

- foundation

- basement

- any other visible structure

Many inspectors also offer additional services, including radon testing, water quality testing and energy audits.

It is important to note that the home inspection does not tell you if the structure is in compliance with current building codes. It also does not ensure protection against future problems.

A furnace may pass a home inspection, only to break six months later. In addition to this, a home inspection does not reveal the value of the home. The sole purpose of the home inspection is to ensure that the buyer knows what they are buying.

Repairs Needed

Once the home inspection is complete, the buyer should evaluate whatever issues the inspection brought to light.

As soon as possible, the buyer should make a list of the issues he or she believes the seller needs to address before closing on the property, and the list is sent to the seller via the real estate agent through a contract referred to as an addendum for repairs.

No house is perfect, and just because a home inspection turns up problems, does not mean the house is an unwise purchase. If large repairs are necessary, further negotiations may be required.

An issue that will require a costly repair, such as a cracked foundation or a roof that needs to be replaced, can result in further negotiations. The buyer may present the seller with an addendum, requesting that they fix the problems before the sale.

The seller may counter by agreeing to fix some of the problems or cover a portion of the expense of the repairs.

Your agent can assist you in determining how to proceed with further negotiations, as attempting to save money may result in the loss of the property.

The best way to avoid an ugly situation is to have an inspection done before you actually put your home on the market with your Real Estate Agent or as soon as you do. The inspector can reveal to you privately what might come up during a home inspection.

You can repair these items in advance to be better prepared when the buyer makes their offer.

[su_divider]

Final Walk-Through

When you’re buying a home, there are so many things to make sure that you do. You have to hire a real estate agent, find the perfect home, make an offer, and get a mortgage loan along with a multitude of other to-do’s.

Once you’ve finished all these things and the home is nearly yours, it’s important to do a final walkthrough.

Before any closing documents are signed or you move any of your personal belongings in, this is the final step in a home purchase. These have to be done between a week and 48 before closing to ensure the house is what you expect as-is.

A final walk-through is different from all of the earlier viewings because it is the buyer’s last chance to go through the house and make sure that it is in the condition that your contract specified.

It allows to you make sure any requested repairs or changes have been made accordingly, and to make sure that the seller did not cause any additional damage when moving out.

Occasionally, a hasty seller or a reluctant tenant can damage the house while moving, leave a mess or leave behind some of their belongings that you don’t want.

You also need to make sure that any appliances or other items that you negotiated for have been left behind and not accidentally moved.

The walkthrough is the best way to make sure that when buying your new home, there are very few surprises lurking anywhere.

The walkthrough should occur close to the closing date, and preferably during daylight hours so that you can see everything in bright, natural light. Make sure that you also bring a flashlight for any tight spaces, closets, attics or basement areas.

Bring both your real estate agent and a copy of your contract to review as you look through all the details in your home.

This will help remind you of everything that you and the seller agreed upon while you drafted up the final contract.

It’s important because usually it has been weeks since you last saw the house and you may forget a few things.

Once you do the final walk-through and sign the final closing papers, you adopt every aspect of the home as-is and you can no longer hold the seller accountable.

Make sure that no matter how excited you are about your new home, that you take the time to examine every detail.

Check every room and the outside property because once your new home exhilaration wears off, you’re stuck with everything – good or bad.

Usually, you want to schedule your walkthrough as close to the final closing as you can so that you see your new home at the last minute as possible. That way you can lessen the chance of any damage occurring before you sign on the house.

In the Vegas real estate market, for example, it’s most common to do a walkthrough 24 hours before closing.

While typically for a walkthrough, later is better, if your contract states repairs that the seller is supposed to make, you should schedule two walkthroughs.

That way you can review the changes and still have time for any necessary negotiations or additional repairs if you are not satisfied.

Don’t be afraid to be vocal about your concerns if something appears to not meet the conditions of your contract.

Communication is vital between buyers, sellers and real estate agents to make sure everyone is happy with the settlement.

[su_divider]

Costs When Buying a House

Closing costs when buying a house in Las Vegas are a pretty standard list. That being said, who pays for what has everything to do with the type of loans and what was agreed to in the written contract.

#1: Inspection Fees

The mortgage appraisal normally entails a visit by the lender’s surveyor to check the property is not being sold at a vastly inflated price, and that there are no obvious structural problems.

A home inspection, on the other hand, tests the construction of the walls, ceilings, roof and other structural elements of the building, evaluates the driveway, landscaping, drainage, and exterior, checks plumbing, electrical systems, HVAC equipment, furnaces, smoke detectors, and even appliances.

In other words, it’s a detailed report of the home’s condition that raises any red flags for potential buyers.

In Nevada, you can expect to pay $350-$400 and more on a larger home. In most cases, the buyer pays for the home inspection upfront. They have the option of requesting it to be refunded at closing, but that’s not frequently done.

#2: Closing Costs

Closing costs are the fees charged by mortgage lenders and third parties related to the purchase of your home. They include a fee for checking your credit report, loan origination fee, government recording charges, appraisal fee, title service fee, and title insurance.

Some buyers are able to negotiate with the seller for a contribution toward these costs; otherwise, expect to pay between 2 and 5 percent of the purchase price in closing costs.

Some loan programs require the seller to pay the closing costs on behalf of the buyer, or certain closing costs.

This is all negotiable and has to be agreed to in the purchase contract and any addendums before closing.

#3: Property Tax

As a homeowner, you pay an annual property tax to your county or municipality.

The amount depends on the appraised value of your home; the more your home is worth, the more you should pay.

#4: Mortgage Insurance

If you take out a conventional loan with a loan-to-value ratio (the amount you borrow compared to the value of your home) of 80 percent or more, then you likely will pay private mortgage insurance.

PMI pays the mortgage company if you don’t make pay your mortgage. Typically, the insurance premium is added to your monthly mortgage payment, but that payment reduces as you pay down the loan and stops when you have 20 percent equity.

FHA borrowers always pay mortgage insurance for the full lifetime of the loan.

#5: Homeowners Insurance

Homeowners insurance pays out if your home is damaged or destroyed by any of the calamities listed on the policy. The more risks the policy covers, the higher the premium.

In most cases, the mortgage company asks you to pay your property tax and insurance premiums into an escrow account each month. The lender, via an escrow company, takes money from the escrow account to pay your bills. This gives the lender peace of mind that your bills are being paid on time.

Most lenders ask for large escrow deposits upfront, and this often throws first-time homebuyers a loop. Borrowers are often required to deposit a full years’ worth of homeowner’s insurance premiums, plus several months’ property tax, in advance. That can run to several thousand dollars, depending on where you live.

#6 HOA and Condo Fees

Homeowners associations and condo fees pay for communal expenses, such as painting the lobby, landscaping and cleaning the communal pool.

They are also money out of your pocket. Ask to see the HOAs financial document before you commit to buy, and check that you can afford the payments. Failing to pay an HOA bill has serious consequences. In most cases, the HOA can fine you.

In serious cases of default, the HOA may foreclose your home.

#7: Moving Costs

Unless your family and friends are prepared to help you shift boxes into your new home, a moving truck is inevitable. Costs vary, depending on whether you hire a truck and move, or call in a professional moving company.

The further you have to travel, and the more stuff you have to move, the more you pay. Most companies can give you a quote over the phone.

#8: Maintenance

When the keys are delivered you’re on your own: which means that if the pipes burst in the early hours of the morning, you’re the one who has to fix it. Having a few DIY skills can help keep the costs down, but there are some things, such as mitigating mold in a damp basement, that you may not be able to do yourself.

Home maintenance costs run, on average, to 1 to 2 percent of the home’s value each year, though older homes may cost more. Aim to establish an emergency fund to handle any unwelcome surprises.

Disclosure

It’s worth noting that most of the additional costs borrower’s face isn’t exactly hidden and, if you’re worrying about whether you can afford a home, you probably shouldn’t.

Here’s why. By law, your lender must make sure that you can afford your mortgage. Before underwriting your loan, the lender adds up your monthly expenses, including your mortgage payment and all the costs listed above, and verifies that these expenses do not exceed a certain proportion of your income – a maximum of 43 percent, but most lenders look for a lower debt load of around one-third of your income.

After all, they don’t want you to run into financial trouble and not be able to make the monthly payment.

Before you close, you’ll receive an estimate that sets out the costs associated with your home loan. In other words, you know upfront what your closing costs are going to be and can budget for them.

[su_divider]

Timeline When Buying a Home in Las Vegas

Here is where you will pay your final fees and sign all of the documents. In Nevada, you can assume about 45 days from escrow to close if you are getting a loan.

In this state, you don’t get your keys until everything is signed and then recorded. It’s not done at the table as it is in some other states. Your agent will get you your keys once the home has recorded.

Lori Ballen Team

Choose a real estate agent that can help you achieve your goals. Buy, Sell, Refer with Lori Ballen Team of Keller Williams Realty Las Vegas.

[su_divider]

Frequently Asked questions

Although the standard answer is 7 years, it really depends on your personal history, credit score, current employment and so forth. It is your best bet is to connect with a lender and get an inside look at your finances today. Your agent can connect you with a lender.

Most lenders want to see your DTI, Debt to Income Ratio at under 35%. This means your debt should be less than 35% of what you earn. If you earn $60,000 and want to buy a house, your debt should be under $21,000 ideally.

There are for sale by owner home listings in the market. You can deal directly with the seller. This being said, using a buyers agent in Nevada is generally paid for by the seller for you. It is in your advantage to have your own solid representation through this process.

It’s possible. It’s more probable that you will find a loan program with a low downpayment. Talking to a lender about today’s loan programs costs you nothing. Ask your agent to connect you with someone that can discuss the various types of loan programs on the market today.

‘AS IS’ basically means the seller isn’t going to make any repairs. This was common in foreclosures and short sales. What’s important to note though is that it doesn’t mean you can’t have a home inspection during the due diligence period – which you should. It also doesn’t mean that the seller doesn’t have to provide a seller disclosure which is a document to inform you of any known issues with the house. They are still required to disclose all material defects.

There are programs offered to people who qualify with a credit score as low as 580. A credit score of 620 could be enough to qualify for an FHA Loan or another buyer loan program.

[su_divider]

Glossary of Frequently used Real Estate Terms

Acceleration ClauseThe acceleration clause in a mortgage contract states that the entire balance of the debt is due and payable in full should the mortgagee default on the mortgage.

Acquisition Cost

The acquisition cost combines the purchase price with the estimated closing costs of the home.

Adjustable Rate Mortgage

An adjustable rate mortgage is also referred to as an ARM. This type of mortgage includes a lower initial rate of interest that changes after a predetermined time has passed and it is adjusted periodically. At that point, the interest rate increases according to predetermined conditions that were selected at the origination of the mortgage. This type of mortgage is also referred to as a variable mortgage.

Amortization

Amortization is the scheduled payment of a loan or debt through systematic monthly payments that are equal in value and continue on a scheduled basis (monthly) until the entire mortgage is repaid in full. The details for each payment over the course of the mortgage are listed in an amortization schedule. Additionally, the payments are separated into the portions allotted for the principal balance and the interest charged.

Annual Percentage Rate

The annual percentage rate is also referred to as the APR. As required by the Federal Truth in Lending Law, lenders must present potential borrowers with the APR or annual cost of the mortgage. The annual percentage rate should accurately reflect the cost of obtaining and holding a mortgage for an entire year. The APR is designed as a comparison tool so that potential borrowers can select the mortgage that provides the lowest annual cost, provided that they qualify for it.

Application Fee

An application fee is the amount that a lender charges the borrower to process his mortgage application. This fee does not include all of the costs associated with obtaining a mortgage, nor does it guarantee the borrower approval for the mortgage.

Appraisal

Appreciation

Appreciation is the term used to indicate the increases in the value of a property due to fluctuations in the market or improvements and renovations.

Assumable Mortgage

An assumable mortgage is one in which the buyer can take over the existing mortgage when a property is sold.

Balloon Mortgage

A balloon mortgage is a mortgage that includes fixed monthly mortgage payments for a predetermined term or number of years. After this time has passed, the balance of the mortgage is due and payable in one lump sum or balloon payment. Typically, this final payment is very large. Borrowers who expect to come into a financial windfall years down the line might be interested in this type of mortgage.

Balloon Payment

A balloon payment is the final payment of a balloon mortgage. It is typically a sizeable amount.

Bill of sale

The bill of sale, a legal document, transfers the title to the property from one individual or entity to another.

Biweekly mortgage

A biweekly mortgage is a mortgage that requires the borrower to make mortgage payments biweekly or every two weeks. This practice leads to the equivalent of thirteen mortgage payments per year, reducing the principal balance of the mortgage more quickly than twelve payments a year would.

Blanket Mortgage

A blanket mortgage implements the use of more than one property as collateral for the mortgage.

Bridge Loan

A bridge loan is used for short-term financing issues such as the acquisition of a mortgage prior to the acquisition of the funds intended to pay for the mortgage.

Clear Title

A clear title is one for which no other owners have been found for the property and unexplained liens or legal issues do not exist.

Closing

The closing is the term that refers to the final transaction relating to the transfer of the property and its title.

Closing Costs

Closing costs are those that are paid during the finalization of the purchase of real estate, which is also referred to as the settlement. Typically, closing costs include such fees as an origination fee, recording fees, document fees, points, the cost of the title insurance for the property, the payment of real estate taxes either in repayment to the seller or for the escrow account, the cost of the title insurance for the property, fees for any surveys that have been taken, attorney fees (if applicable), and the repayment of real estate taxes.

Closing costs can also include other fees such as the payment of insurance on the home. In some cases, the seller might actually pick up some of the closing costs for the buyers, depending on the agreement.

Collateral

Collateral is the property that is used to secure the mortgage. With home sales, the real estate property that has been purchased is used as the collateral for the mortgage. If the loan is not repaid in full, the home or real estate property is often repossessed by the lender to recover the debt.

Construction Loan

A construction loan is one that covers the cost of construction. It is usually a short-term loan that advances funds to the builder during the time the home or building is under construction.

Conventional Mortgage

A conventional mortgage is one that has no additional guarantees for repayment beyond the property itself. This means that no guarantees have been offered through FHA or the VA.

Conversion Option

Conversion options allow certain loans to be changed after their origination. Predetermined conditions must be met as required by the terms set up at the origination of the mortgage. Balloon loans and adjustable-rate mortgages are examples of mortgages that have conversion options.

Credit Score

The borrower’s credit score is important since it is used to help determine the worthiness of the borrower as a credit risk. Credit scores are based upon the current and past credit histories of consumers. The credit report includes information from many areas including credit card usage, bill payment history, loan history, bankruptcies, employment, and more. Credit scores assist lenders with the difficult task of determining the risk factor associated with specific borrowers.

Deed

A deed is a legal document that indicates ownership of a piece of real estate. This document transfers the title of a property that changes hands from one owner to another.

Deed in Trust

A deed in trust is used in some states instead of the term “mortgage.”

Deposit as it relates to mortgages

Deposits are presented in advance of the closing. They are given as security or as a guarantee that the potential homebuyer is serious about purchasing the home. The deposit is also referred to as the “earnest money deposit.”

Depreciation

Depreciation is the term used to indicate the decreases in the value of a property due to fluctuations in the market or failure to maintain the property.

Down Payment

The down payment associated with a mortgage is the amount of money (whether cash or check) that the borrower pays towards the purchase price of the house or real estate property. Typically, the down payment is paid at the closing or settlement.

In some cases, a piece of real estate might refer to an easement in the deed. The easement gives someone other than the owner access to the property. If the neighboring property does not have direct road frontage, the deed might list an easement for this property owner so that he can gain access to his property.

Equity

The equity of a home is the difference between the current market value of the property and the total amount borrowed on the property.

Escrow

In general, lenders set up an escrow account to hold money that has been collected each month along with the loan payment. It includes a percentage of the money that needs to be paid toward property taxes and insurance. The lender will then make the payments at the appropriate time. Learn more about escrow in the Nevada Home Buying Process.

Fannie Mae

Fannie Mae is a short way of indicating the Federal National Mortgage Association or FNMA. It is a large supplier of mortgages for the entire nation.

FHA

The FHA or Federal Housing Administration is an agency of the United States Department of Housing and Urban Development or HUD. It guarantees certain loans obtained by qualified buyers.

First Mortgage

Obviously, the first mortgage is the one that the borrower has taken out on the property before any other mortgages or loans. This mortgage or loan holds the primary lien against the property and the holder of this mortgage has first claim for repayment of the mortgage should the home go into foreclosure.

Fixed-Rate Mortgage

A fixed-rate mortgage is also referred to as a traditional mortgage. This type of mortgage is one in which the mortgage payment is a specified amount that never fluctuates. The interest percentage charged against the borrowed amount remains the same throughout the term of the mortgage. The amount of the mortgage payment that goes toward the principal will gradually increase as the amount of the mortgage payment that goes toward the interest gradually decreases.

Floating

Floating is the term used to describe the borrower’s strategy not to lock in the interest rate for the mortgage he has applied for.

Good Faith Estimate

The Best Faith Estimate is an estimate provided by the lender to the borrowers. It delineates an estimate of the total costs of securing the mortgage.

Grace Period

Borrowers are usually permitted 15 days grace for making late mortgage payments without incurring a penalty such as a late fee.

Grantee

The grantee is the individual who is receiving the property in question.

Grantor

The grantor is the individual who is selling the property in question.

Homeowners Insurance

Homeowner’s insurance is usually required by mortgage lenders to protect their investment. They are typically listed on the homeowner’s insurance policy. The homeowner’s insurance provides hazard insurance as well as liability insurance.

Homeowners Warranty (Home Warranty)

A homeowner’s warranty is an insurance policy on the home that covers certain types of repairs for a predetermined time.

Insurance

Typically, lenders require that homeowners obtain homeowner’s insurance as a way of safeguarding their investment. The lender is listed as the primary beneficiary on the insurance policy. Should the home be destroyed or damaged beyond repair, the lender can collect the balance of the mortgage from the insurance company.

Interest

The interest associated with a mortgage is the fee that the lender charges on a monthly or annual basis for loaning the money to the borrower. This fee is a percentage of the total amount that has been borrowed.

Interest-Only Mortgage

In an interest-only mortgage, the borrower pays only the interest that is due on the mortgage for the first term of the loan. This term is predetermined at the origination of the loan. Ten-year terms are very common for this portion of an interest-only mortgage. After this term has passed, the mortgage converts to a fixed-rate mortgage with fixed monthly payments that include both the principal and the interest portions of the mortgage.

Lender

A lender is the individual, bank, or company that is offering the mortgage to the borrower.

LIBOR index

The LIBOR index stands for London Interbank Offered Rate Index. It refers to the average of the interest rates that international banks charge for borrowing United States dollars in the London market. It takes into consideration the rates charged by major banks only.

Late Fee

Late fees are monetary charges that are assessed on a mortgage debt to borrowers when they are late making their mortgage payments.

Loan Balance

A loan balance is the amount of money that it would take to satisfy the loan debt in full. It is often referred to as the principal amount plus the interest that is due.

Loan Term

The loan term varies from one loan to the next. It is defined as the number of years that a loan is going to be held or amortized. The most popular loan terms are fifteen, twenty, or thirty years.

Merged Credit Report

A merged credit report is formulated from credit reports obtained from more than one credit bureau.

Mortgage

A mortgage is a binding financial agreement between two parties, the mortgagee and the mortgagor. This legal transaction is a loan from one party to the other, typically for a piece of real estate.

Mortgagee

The mortgagee refers to the lender in a mortgage agreement.

Mortgage broker

A mortgage broker is an individual or company that originates a mortgage or loan between the borrower and lender.

Mortgagor

The mortgagor refers to the borrower in a mortgage agreement.

Negative amortization

Negative amortization occurs when a borrower pays less than the amount due on a loan or mortgage. As a direct result, the loan balance does not decrease as it would otherwise with proper payments.

Origination Fee

Origination fees are those that the lender charges the borrower for processing his loan application.

Owner Financing

Owner financing occurs when the seller finances the loan or mortgage. The mortgagor makes the payments for the loan to the seller who is also the mortgagee in this case.

PMI

PMI is short for private mortgage insurance. This type of insurance is often required by the lender in order to protect his investment. PMI protects the lender’s monetary investment in case the borrower goes into default on the loan. The payments for PMI are usually included with the monthly mortgage payment.

Points

Points are typically charged when a borrower acquires a mortgage. It is simply one of the fees associated with the process. In most cases, a borrower can pay additional points in order to obtain a lower interest rate. Each point is equal to 1 % of the amount of the mortgage. One example would be the following scenario. The borrower acquires a mortgage for $100,000 at 3 points. Since each point is equal to 1 % of the amount of the mortgage, the borrower owes $3,000 or 3% of the mortgage. The lender charges the points. Points can be negotiated by the lender and the borrower for a specific interest rate and term within the limits that the lender is offering.

Prime Rate

Prime rate is the term used to describe the best or lowest interest rate, which is typically offered to borrowers with excellent credit histories.

Principal

The term, principal, is used to indicate the total amount of debt, not counting the interest charges that are due on it.

Property Taxes

Assessed by local or state governments, property taxes are assessed on the value of the home. Homeowners pay these taxes on an annual basis according to a predetermined timeline.

Quitclaim Deed

A quitclaim deed is one in which the grantor transfers whatever rights he has in the title to a property. It does not provide a guarantee that no one else has any claim to the title.

Recording Fee

The recording fee is an additional charge that covers the cost to record the documents relating to the mortgage. Typically, this transaction takes place at a public office such as the recorder’s office.

Reverse Mortgage

A reverse mortgage is one in which the homeowners receive money from a lender based on the equity of their home, which is used as collateral. Initially, they do not need to repay the loan. In fact, the loan is not repaid until the home is sold or the homeowner no longer resides in it.

Refinance

Refinance is the process that occurs when a borrower pays one loan off with the acquisition of a new one.

Secured Loan

A secured loan is one that is acquired by offering collateral for the loan. In the case of home mortgages, the home is offered as collateral or security for the loan.

Senior Loan

A senior loan is the loan that takes precedence over all other loans. In the event that the homeowner defaults, this loan is paid off first.

Tax Lien

A tax lien is placed against a property when unpaid taxes are past due.

Title

A title is a legal document that indicates an individual’s ownership of a specific piece of real estate.

Title Company

A title company performs searches on titles to properties to ensure that the individual who claims title to a property actually has it.

Title Insurance

Title insurance protects the homeowner against any errors that occur during the title search. This includes disputes that might arise over property ownership. A fee is required to obtain title insurance.

Title Search

A title search is the actual process of checking records on the property in an effort to verify that the seller is the actual owner of the property.

Transfer Tax

Transfer tax is the tax that the state assesses when a title is transferred from one owner to another.

Truth in Lending

The Truth in Lending Law requires lenders to provide potential borrowers with the actual costs of borrowing money. The annual percentage rate is the figure that lenders provide to indicate the annual cost of obtaining a loan.

Variable rate mortgage?

A variable rate mortgage is another term for an adjustable-rate mortgage. With this type of mortgage, there is a lower initial rate of interest that changes after a predetermined time has passed and is adjusted periodically.

Have a Stress Free Move

Hopefully, you now feel prepared and no longer wonder how to buy a house. Hiring the right real estate agent matters, and we hope you will choose Lori Ballen and Associates at 702-604-7739. Call for your 1st time home buyers guide or a home buying checklist of questions to ask your agent.